Ποια είναι η βασική διαφορά μεταξύ των SS άντλησης “ρευστότητας” στη βρετανική οικονομία μέσω μαύρη αγορά στη δεκαετία του 1940 και η Federal Reserve άντλησης “ρευστότητας” στην οικονομία των ΗΠΑ σήμερα;

Ποια είναι η βασική διαφορά μεταξύ των SS άντλησης “ρευστότητας” στη βρετανική οικονομία μέσω μαύρη αγορά στη δεκαετία του 1940 και η Federal Reserve άντλησης “ρευστότητας” στην οικονομία των ΗΠΑ σήμερα;

Economic law applies regardless of political circumstances

by Tim Kelly/Infowars.com

What is the fundamental difference between the SS pumping “liquidity” into the British economy via black markets in the 1940’s and the Federal Reserve pumping “liquidity” into the US economy today?

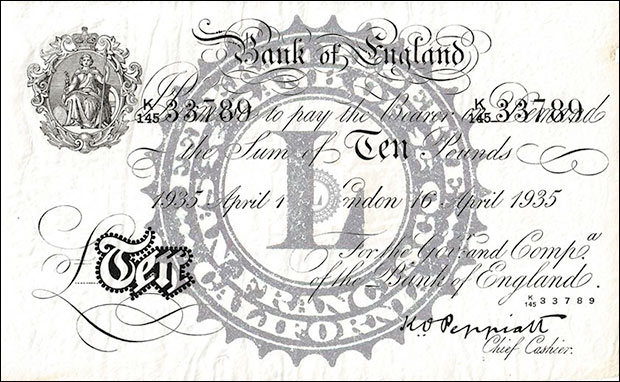

During the Second Word War, Germany devised a secret plan to undermine the British economy by flooding the country with counterfeit Bank of England notes.

Codenamed Operation Bernhard, in recognition of its mastermind, SS Major Bernhard Krüger, the plan involved a team of 142 counterfeiters, drawn primarily from the inmate populations at Sachsenhausan and Auschwitz concentration camps.

Beginning in 1942, the dragooned engravers and artists worked feverishly, forging huge quantities of £5, £10, £20, and £50 notes. By the time of Germany’s surrender in May of 1945, the operation had produced 8,965,080 banknotes worth a total value of £134,610,810, an amount exceeding all the reserves in the Bank of England’s vaults.

The original plan called for the dropping of the forged notes from aircraft flying over Great Britain in the expectation that they would be picked up and eagerly circulated but that part of the scheme was never put into effect. By 1943, the Luftwaffe lacked the capacity to deliver the “economic weapon” in sufficient quantities and the operation was taken over by SS foreign intelligence agents who laundered the counterfeit currency, using it to finance their own espionage activities and pay for strategic imports.

Although Operation Bernhard failed to meet its primary objective (the collapse of the British wartime economy), it was successful in flooding the European black markets with counterfeit pounds, thus undermining confidence in Britain’s currency abroad, and causing its value to plummet.

The Nazi plot may have been the most ambitious counterfeiting racket in history but it pales in comparison to the recent exploits of the world’s central banks, especially those of the Federal Reserve.

The Fed is currently creating, ex nihlio, more than a trillion dollars a year and using the funny money to buy U.S. government debt and mortgage-backed securities and then taking them out of circulation. These purchases have propped up the bond market and kept banks solvent. But they have also caused the Fed’s balance sheet to quadruple, growing from just under $1 trillion in 2008 to nearly $4 trillion today.

And there appears to be no end in sight to the reckless money creation. Janet Yellen, a “monetary policy dove” by all accounts, is about to be confirmed by the U.S. Senate as the next head of the Federal Reserve. Were Messrs. Bernanke and Greenspan “monetary policy hawks?”

Now if a Nazi plot to flood Great Britain with counterfeit currency was a considered a serious threat to that nation’s economy, what are we to make of our own central bank’s policies? What is the fundamental difference between the SS pumping “liquidity” into the British economy via black markets in the 1940′s and the Federal Reserve pumping “liquidity” into the US economy today?

The answer, of course, is there really is no difference. Economic law applies regardless of political circumstances. If you print money faster than the rate of production, you will have more money chasing fewer goods and sooner or later you will have price inflation. It really is just that simple.

An important distinction, however, between the Nazi counterfeiting scheme and the Fed’s current monetary policy is that the US dollar is still the dominant international reserve currency. This “exorbitant privilege” enables US monetary authorities to engage in periodic devaluations without being immediately confronted with a balance of payments crisis or domestic price inflation.

Right now the Fed’s inflationary policies have yet to show up in the Consumer Price Index though there are those who claim the rate of price inflation has been purposely understated by the US government. And indeed consumer prices have gone up in the last five years.

It should also be taken into consideration that the consequences of currency devaluation can manifest themselves in ways other than overt sticker shock. For instance, producers anticipating consumer resistance to price inflation can reduce the quality or quantity of their goods rather than raise prices. This is happening today as many products are now being packaged in smaller amounts yet are being sold at the same price.

Moreover, when you’re measuring price inflation, your baseline is crucial to your analysis. Absent intervention by the US government and the Fed, the Crash of 2008 would have precipitated widespread deflation. This did not happen as the US Treasury and central bank pumped in trillions of new dollars to arrest the panic. The new money has created relative “price stability” in the past few years but this itself is evidence of inflation because otherwise prices would have fallen.

And we can look at bond prices as evidence of inflation. The bond market is an enormous bubble that has been intentionally created by the Fed in order to forestall the inevitable reckoning for decades of overspending by the Congress.

That said, the dreaded hyperinflation that many predicted would happen has yet to occur. Why?

It appears the inflationary deluge is being held back by the Fed’s policy of paying banks not to lend money. Boston University economist Laurence Kotlikoff elaborated on this very point in Forbes last September. He wrote:

But why haven’t prices started rising already if there is so much money floating around? This year’s inflation rate is running at just 1.5 percent. There are three answers.

First, three quarters of the newly created money hasn’t made its way into the blood stream of the economy – into M1 – the money supply held by the public. Instead, the Fed is paying the banks interest not to lend out the money, but to hold it within the Fed in what are called excess reserves.

Since 2007, the Monetary Base – the amount of money the Fed’s printed – has risen by $2.7 trillion and excess reserves have risen by $2.1 trillion. Normally excess reserves would be close to zero. Hence, the banks are sitting on $2.1 trillion they can lend to the private sector at a moment’s notice. i.e., we’re looking at an gi-normous reservoir filling up with trillions of dollars whose dam can break at any time. Once interest rates rise, these excess reserves will be lent out.

But, and this is point two, other things aren’t equal. As interest rates and prices take off, money will become a hot potato. i.e., its velocity will rise. Having money move more rapidly through the economy – having faster money – is like having more money. Today, money has the slows; its velocity – the ratio GDP to M1 — is 6.6. Everybody’s happy to hold it because they aren’t losing much or any interest. But back in 2007, M1 was a warm potato with a velocity of 10.4.

If banks fully lend out their reserves and the velocity of money returns to 10.4, we’ll have enough M1, measured in effective units (adjusted for speed of circulation), to support a nominal GDP that’s 3.5 times larger than is now the case. I.e., we’ll have the wherewithal for almost a quadrupling of prices. But were prices to start moving rapidly higher, M1 would switch from being a warm to a hot potato. i.e., velocity would rise above 10.4, leading to yet faster money and higher inflation.

So, if commercial banks began lending at a rate resembling the historical norm, we would soon be experiencing hyperinflation. That is hardly a comforting thought. I suppose the only saving grace at that point would be in an economy already laden with massive debt, there might be very little demand for more credit and thus the money multiplier effect may not kick-in, at least not with the vengeance foreseen by Mr. Kotlikoff.

The Fed’s massive intervention into the market has been defended by the usual Keynesian suspects as a necessary measure to spur economic recovery. And yes, the Fed’s overheated printing presses have fueled a stock market boom. Unfortunately, this latest bubble has not lifted the real economy which remains in the doldrums. Private sector investment remains low and unemployment high.

The problem with this situation is the moment the Fed takes away the easy money, the market will collapse. Indeed, we have reached a point where just the suggestion of the Fed “tapering off” sends financial markets into a panic.

So the Fed has painted itself, and the entire U.S economy, into a corner. There is no way the Fed can stop creating money and liquidate its bloated balance sheet without reaping a deflationary whirlwind. And with an economy addicted to perennial trillion-dollar budget deficits and consumer debt, the political will to stomach such a painful yet necessary correction is not likely to be manifested anytime soon.

Vladimir Lenin is reported to have said, “the best way to destroy the capitalist system is to debauch the currency.” He was right. So why is the Fed following the advice of a deceased communist revolutionary?

No, I don’t think it is because the Federal Reserve Board has been infiltrated by communist moles, or Nazi agents for that matter. Although it is difficult to imagine commie saboteurs doing more damage to the U.S. economy than the monetary commissars now in charge at the Eccles building.

Perhaps the famed economist and alleged Fabian socialist John Maynard Keynes provided the answer when he wrote:

By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million is able to diagnose.

That ratio has probably improved somewhat lately. A greater portion of the public appears to be catching on to the Fed’s monetary sleights of hand. The increasing demand for physical gold and silver as well as the various state initiatives to re-monetize those precious metals are auspicious signs of such an awakening.